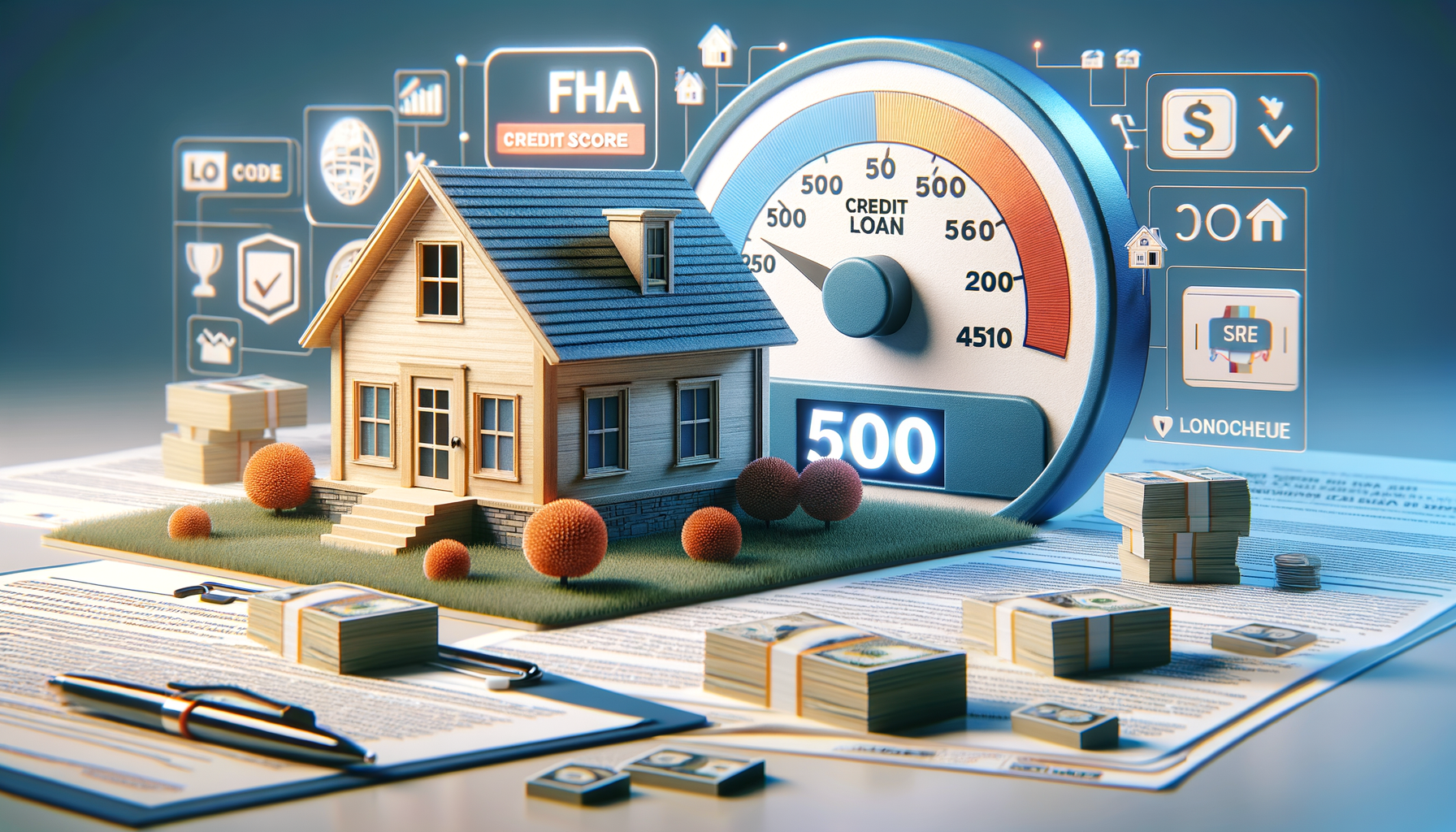

Understanding FHA Loans: A Gateway to Homeownership

FHA loans, or Federal Housing Administration loans, are a type of government-backed mortgage designed to help individuals with lower credit scores and limited financial resources achieve the dream of homeownership. Established in 1934, these loans have become a cornerstone for many first-time homebuyers. The FHA does not directly lend money but instead insures loans provided by approved lenders, reducing the risk for lenders and making it easier for borrowers to qualify.

One of the key attractions of FHA loans is their lenient credit requirements. While conventional loans typically require a credit score of at least 620, FHA loans can be obtained with scores as low as 500, provided the borrower can make a 10% down payment. For those with scores of 580 or higher, the down payment can be as low as 3.5%. This flexibility opens doors for many who might otherwise struggle to secure financing.

Additionally, FHA loans offer competitive interest rates, often lower than those of conventional loans, making monthly payments more affordable. The program also allows for higher debt-to-income ratios, recognizing that many potential homeowners carry significant student loan or credit card debt. These features make FHA loans a viable option for a wide range of borrowers, particularly those navigating financial challenges.

Eligibility Criteria and Requirements

To qualify for an FHA loan, borrowers must meet several criteria. First and foremost, they must have a steady employment history or have worked for the same employer for the past two years. This demonstrates financial stability and the ability to make consistent mortgage payments. Borrowers must also provide proof of income, typically through pay stubs, tax returns, and W-2 forms.

Another crucial requirement is the down payment. As mentioned earlier, borrowers with credit scores of 580 or higher can make a down payment as low as 3.5%. However, those with scores between 500 and 579 must provide at least a 10% down payment. This requirement ensures that borrowers have a vested interest in the property and reduces the risk for lenders.

Borrowers must also have a valid Social Security number, be a lawful resident of the U.S., and be of legal age to sign a mortgage in their state. The property being purchased must serve as the borrower’s primary residence and meet certain safety and livability standards set by the FHA. These standards ensure that the home is safe and habitable, protecting both the borrower and the lender.

- Steady employment history

- Proof of income

- Minimum credit score requirements

- Valid Social Security number

- Primary residence requirement

The Application Process: Steps to Secure an FHA Loan

Applying for an FHA loan involves several steps, starting with finding an FHA-approved lender. These lenders have been vetted by the FHA and are authorized to issue FHA-backed loans. Potential borrowers should compare offers from multiple lenders to find the most favorable terms and interest rates.

Once a lender is selected, the borrower will need to complete a loan application, providing detailed information about their financial situation, employment history, and the property they wish to purchase. The lender will then review this information to determine eligibility and assess the borrower’s creditworthiness.

If the application is approved, the lender will issue a loan estimate, outlining the terms of the loan, including the interest rate, monthly payments, and closing costs. Borrowers should carefully review this document and ask questions if any terms are unclear. Once the borrower agrees to the terms, the lender will order an appraisal of the property to ensure it meets FHA standards.

After the appraisal, the loan will move to underwriting, where the lender will conduct a thorough review of the borrower’s financial information and the property’s value. If everything checks out, the lender will issue a final approval, and the loan will proceed to closing. At closing, the borrower will sign the loan documents, pay the down payment and closing costs, and receive the keys to their new home.

Benefits and Drawbacks of FHA Loans

FHA loans offer several benefits that make them attractive to potential homeowners. The lower credit score requirements and smaller down payments are significant advantages, particularly for first-time buyers or those with limited financial resources. Additionally, FHA loans come with competitive interest rates, which can result in lower monthly payments and long-term savings.

Another benefit is the ability to finance closing costs, which can be rolled into the loan amount. This feature reduces the upfront costs of purchasing a home, making it more accessible for many buyers. Furthermore, FHA loans are assumable, meaning that if the homeowner decides to sell the property, the buyer can take over the existing loan, potentially at a favorable interest rate.

However, there are also drawbacks to consider. FHA loans require borrowers to pay mortgage insurance premiums (MIP), both upfront and annually. This insurance protects the lender in case of default but adds to the overall cost of the loan. Additionally, the property must meet certain standards, which can limit the types of homes available to FHA borrowers.

In summary, while FHA loans provide an accessible path to homeownership, borrowers should weigh the benefits against the potential costs and limitations. Understanding these factors will help them make an informed decision that aligns with their financial goals and circumstances.

Conclusion: Navigating the FHA Loan Landscape

For many aspiring homeowners, FHA loans represent a viable pathway to achieving their dreams. By offering lower credit score requirements and smaller down payments, these loans open doors for individuals who might otherwise face significant barriers to homeownership. However, as with any financial decision, it’s crucial for potential borrowers to thoroughly understand the terms, benefits, and potential drawbacks of FHA loans.

By doing their homework, comparing offers from different lenders, and considering their long-term financial goals, borrowers can make informed decisions that support their journey to homeownership. Whether you’re a first-time buyer or someone with past credit challenges, FHA loans can provide the support and flexibility needed to take that crucial step onto the property ladder.

Leave a Reply