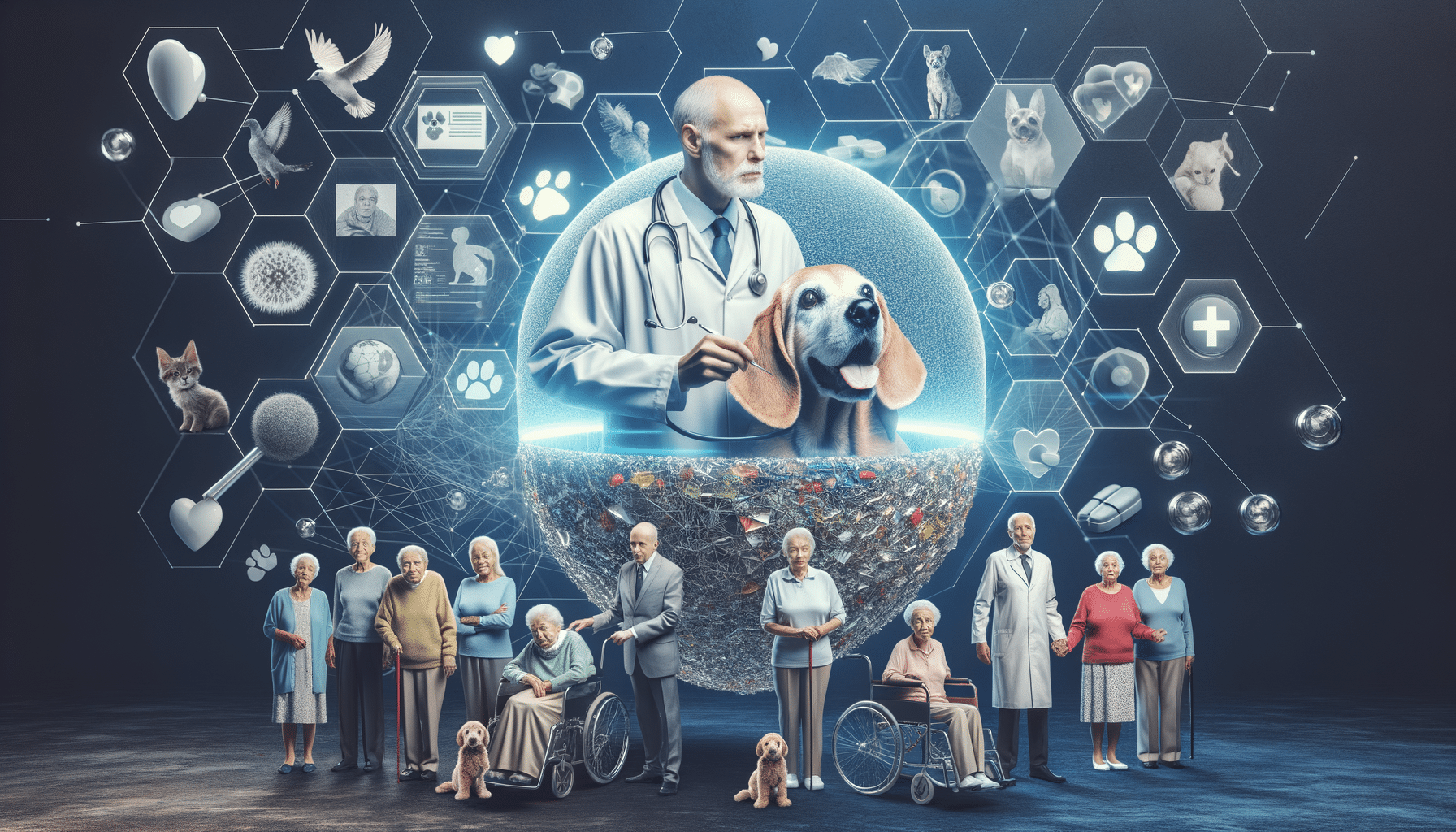

Low Cost Pet Insurance Options For Seniors

Introduction

As we age, our beloved pets often become even more integral to our lives, providing companionship and joy. However, ensuring their health can sometimes strain a senior’s budget. Pet insurance offers a viable solution to manage unexpected veterinary costs, but finding affordable options can be challenging. This article explores low-cost pet insurance options tailored for seniors, ensuring that your furry friends receive the care they need without financial stress.

Understanding Pet Insurance Basics

Pet insurance functions similarly to human health insurance by covering a portion of medical expenses. Policies typically include coverage for accidents, illnesses, and sometimes routine care. Understanding the basics can help seniors make informed decisions:

- Premiums: The monthly cost of maintaining the insurance policy.

- Deductibles: The amount paid out of pocket before coverage starts.

- Reimbursement Level: The percentage of vet bills the insurance company will pay after the deductible is met.

- Annual Limit: The maximum amount the insurance will pay in a year.

By comprehending these elements, seniors can tailor their insurance choices to fit their financial situation and pet’s needs.

Evaluating Low-Cost Options

Finding affordable pet insurance requires careful evaluation of available options. Seniors should consider the following strategies:

- Comparing Plans: Use online tools to compare different insurance providers and their plans.

- Choosing Higher Deductibles: Opting for a higher deductible can lower monthly premiums, making the plan more affordable.

- Excluding Routine Care: Some policies offer lower premiums by excluding routine care, focusing solely on accidents and illnesses.

These strategies can help seniors find a balance between cost and coverage, ensuring their pets receive necessary care without excessive financial burden.

Tailoring Insurance for Senior Pet Owners

Insurance needs can vary based on the pet’s age and health condition. Seniors often have older pets, which may require specific coverage considerations:

- Chronic Conditions: Ensure the policy covers chronic conditions common in older pets.

- Customizable Plans: Look for insurers that offer customizable plans to adjust coverage as the pet ages.

- Discounts for Seniors: Some insurance providers offer discounts specifically for senior pet owners, which can reduce overall costs.

By focusing on these aspects, seniors can find insurance plans that provide adequate coverage for their aging pets.

Conclusion: Ensuring Pet Health Without Financial Strain

For seniors, finding low-cost pet insurance is crucial to maintaining their pets’ health without financial strain. By understanding insurance basics, evaluating low-cost options, and tailoring plans to fit their pets’ needs, seniors can ensure their furry companions receive the care they deserve. This proactive approach not only safeguards the pet’s health but also offers peace of mind to their owners.