Efficient Credit Card Processing Solutions

Introduction to Credit Card Processing Solutions

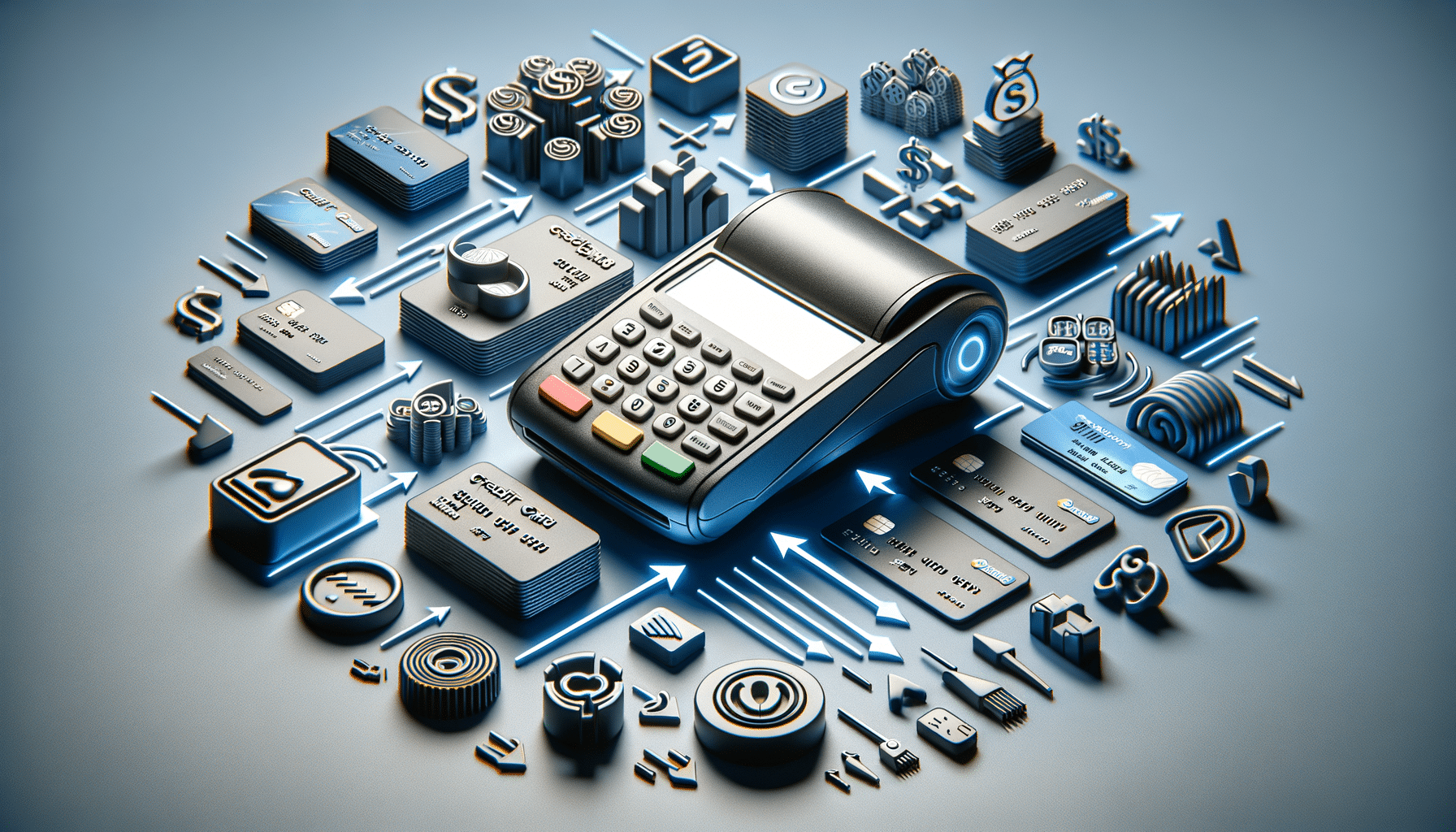

In today’s fast-paced digital world, efficient credit card processing solutions are crucial for businesses aiming to thrive and expand. As consumers increasingly prefer cashless transactions, businesses must adapt to meet these demands. Efficient credit card processing enables seamless transactions, enhances customer satisfaction, and offers businesses a competitive edge. In this article, we will delve into the various aspects of credit card processing, exploring how it can significantly impact small business operations in 2025.

The Importance of Speed in Credit Card Processing

Speed is a vital factor in credit card processing solutions. A swift transaction process not only enhances customer experience but also improves the overall efficiency of business operations. In 2025, businesses that prioritize fast processing times will likely see increased customer retention and satisfaction. Quick processing reduces wait times, which is particularly beneficial during peak hours or busy seasons. Moreover, businesses can handle a higher volume of transactions without compromising on service quality.

To achieve efficient processing, businesses should invest in modern point-of-sale (POS) systems that support rapid transaction speeds. These systems are equipped with advanced technology that minimizes downtime and ensures transactions are processed in real-time. Additionally, partnering with reputable payment processors that offer reliable infrastructure and support can further enhance transaction speed and reliability.

Security Measures in Credit Card Processing

Security is paramount in credit card processing, as it involves the handling of sensitive customer information. In 2025, businesses must implement robust security measures to protect against fraud and data breaches. This includes utilizing encryption technology, tokenization, and secure payment gateways. These measures ensure that customer data is protected during transactions, fostering trust and confidence among consumers.

Businesses should also stay informed about the latest security standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS). Compliance with these standards not only protects customer information but also shields businesses from potential legal and financial repercussions. By prioritizing security, businesses can build a strong reputation and attract more customers.

Cost-Effective Credit Card Processing Solutions

Cost is a significant consideration for businesses when selecting credit card processing solutions. In 2025, businesses will seek cost-effective options that offer value without compromising on quality. This involves evaluating processing fees, transaction rates, and any hidden charges. By understanding the fee structure, businesses can make informed decisions that align with their financial goals.

Many payment processors offer tiered pricing models, allowing businesses to choose a plan that suits their transaction volume and budget. Additionally, businesses can negotiate with processors to secure favorable terms and rates. By optimizing processing costs, businesses can allocate resources to other areas, such as marketing or product development, further driving growth and success.

Future Trends in Credit Card Processing

The landscape of credit card processing is continually evolving, with new trends emerging to meet the demands of modern consumers. In 2025, businesses can expect to see advancements in technology, such as contactless payments, mobile wallets, and biometric authentication. These innovations offer convenience, speed, and enhanced security, appealing to tech-savvy consumers.

Moreover, the integration of artificial intelligence and machine learning in payment systems will enable businesses to analyze transaction data, identify patterns, and make data-driven decisions. This can lead to improved customer experiences, personalized marketing strategies, and increased operational efficiency. By staying ahead of these trends, businesses can position themselves as industry leaders and attract a broader customer base.

Conclusion: Embracing Efficient Credit Card Processing Solutions

Efficient credit card processing solutions are essential for businesses aiming to succeed in 2025 and beyond. By prioritizing speed, security, and cost-effectiveness, businesses can enhance customer satisfaction and drive growth. Staying informed about future trends and technological advancements will allow businesses to remain competitive and meet the evolving needs of consumers. As the world continues to move towards cashless transactions, businesses that embrace efficient credit card processing will undoubtedly thrive in the years to come.