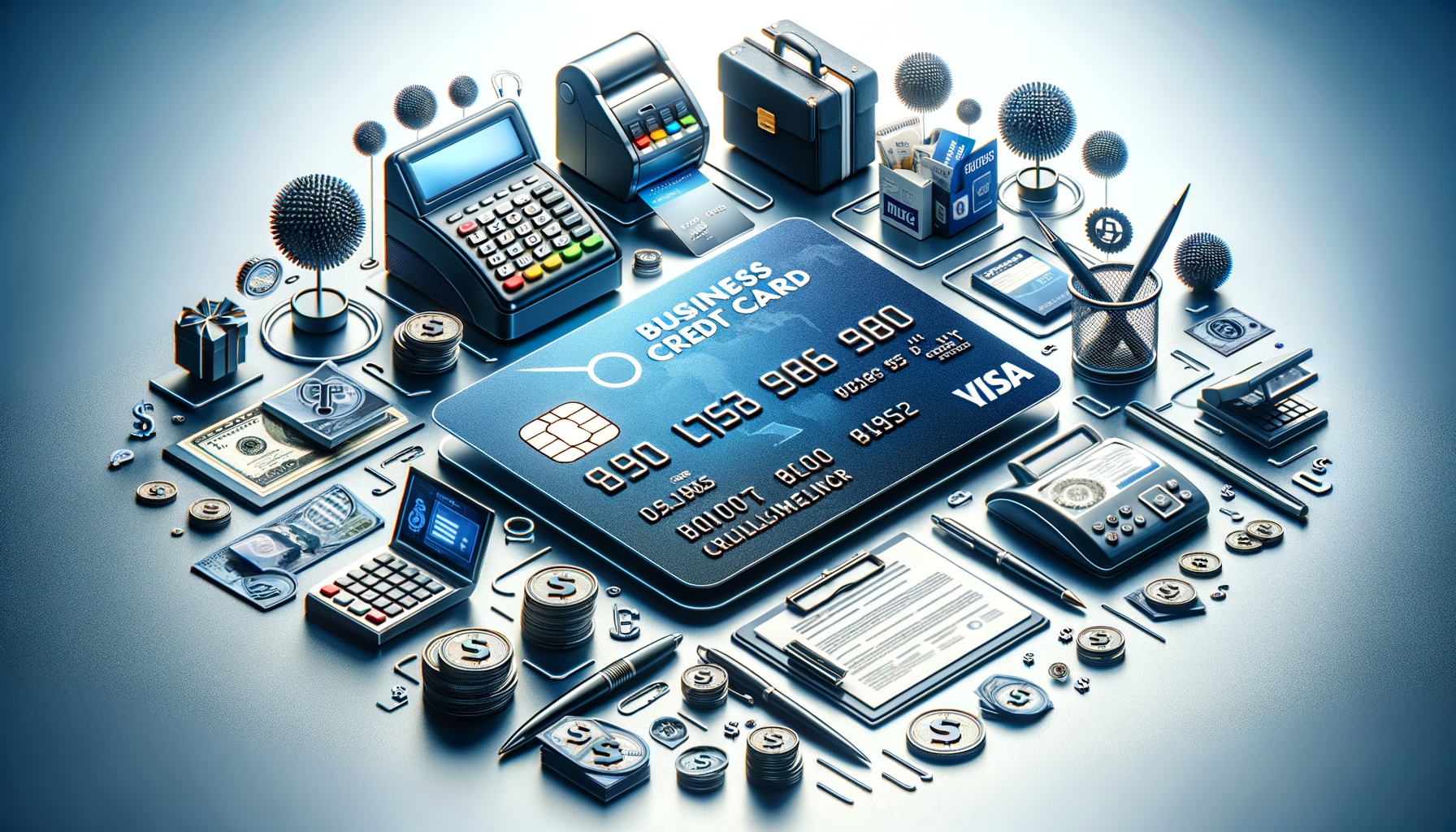

A short guide to business credit cards

Understanding Business Credit Cards

Business credit cards are a financial tool designed specifically for business-related expenses. Unlike personal credit cards, they offer features that cater to the needs of businesses, such as higher credit limits and rewards tailored to business purchases. These cards can be used by small startups and large corporations alike, providing flexibility and convenience in managing company expenses.

One of the primary benefits of using a business credit card is the separation of personal and business finances. This distinction simplifies accounting and bookkeeping, making it easier to track business expenses and prepare for tax season. Additionally, many business credit cards offer detailed spending reports, which can be invaluable for budgeting and financial analysis.

Another advantage is the opportunity to build business credit. Just as individuals have credit scores, businesses also have credit profiles. Responsible use of a business credit card can help improve a company’s credit score, which is crucial when seeking loans or negotiating better terms with suppliers.

Business credit cards also often come with rewards programs that offer cashback, travel perks, and discounts on business services. These rewards can lead to significant savings over time, effectively reducing the overall cost of business operations.

Key Features of Business Credit Cards

Business credit cards come with a range of features designed to meet the diverse needs of businesses. Here are some key features to consider:

- Higher Credit Limits: Business credit cards typically offer higher credit limits than personal cards, providing the financial flexibility needed for larger business expenses.

- Employee Cards: Many business credit cards allow for additional employee cards, enabling business owners to manage and monitor employee spending effectively.

- Expense Management Tools: These cards often include tools that help streamline expense reporting and tracking, which can be integrated with accounting software.

- Rewards and Perks: Business cards often offer rewards such as cashback, travel points, or discounts on business services, which can be tailored to suit the spending habits of the company.

- Introductory Offers: Some cards come with introductory offers such as 0% APR for a certain period or bonus points for spending a specific amount within the first few months.

When selecting a business credit card, it’s crucial to evaluate these features in the context of your business needs. Consider how each feature aligns with your spending habits and financial goals to maximize the benefits.

Comparing Business Credit Cards

Choosing the right business credit card involves comparing various options to find the one that best suits your company’s needs. Here are some factors to consider during the comparison process:

- Interest Rates and Fees: Look at the annual percentage rate (APR) and any associated fees, such as annual fees, late payment fees, and foreign transaction fees. Lower rates and fees can significantly reduce costs.

- Rewards Programs: Compare the rewards programs offered by different cards. Some may offer higher cashback on specific categories, while others provide travel rewards or discounts on business services.

- Credit Limit: Consider the credit limit offered by each card. A higher limit can be beneficial for businesses with substantial monthly expenses.

- Additional Features: Evaluate any additional features such as travel insurance, purchase protection, and extended warranties, which can add value to the card.

It’s also helpful to read reviews and seek recommendations from other business owners to gain insights into the practical benefits and drawbacks of each card. Taking the time to compare options can lead to significant savings and benefits for your business.

Managing Business Credit Card Debt

While business credit cards offer numerous advantages, it’s essential to manage credit card debt effectively to avoid financial pitfalls. Here are some strategies to consider:

- Set a Budget: Establish a clear budget for business expenses and stick to it. This helps prevent overspending and ensures that credit card usage aligns with financial goals.

- Pay in Full: Whenever possible, pay off the full balance each month to avoid interest charges. This practice can also help improve the business credit score.

- Monitor Spending: Regularly review credit card statements to monitor spending patterns and identify any unauthorized charges. This can help prevent fraud and ensure that expenses remain within budget.

- Negotiate Terms: If your business is facing financial difficulties, consider negotiating with the credit card issuer for better terms, such as a lower interest rate or a payment plan.

Effective debt management not only keeps financial health in check but also enhances the credibility and creditworthiness of the business, paving the way for future growth and opportunities.

Conclusion: The Role of Business Credit Cards in Financial Management

Business credit cards are a powerful tool for managing company expenses, building credit, and accessing rewards tailored to business needs. By understanding the features and benefits of these cards, businesses can make informed decisions that align with their financial strategies.

Ultimately, the choice of a business credit card should be guided by the specific needs and goals of the company. Whether it’s maximizing rewards, managing cash flow, or building credit, the right card can provide significant advantages.

As businesses continue to navigate the complexities of financial management, business credit cards remain an indispensable asset in achieving financial stability and growth.